Which companies' results will you be watching this week?

It's not as interesting as last weeks, but there are still some interesting companies for me. I would like to see the results of$HPQ-5.0%, $HRL-2.2% and $COST-5.2%.

Which companies' results will you be watching this week?

It's not as interesting as last weeks, but there are still some interesting companies for me. I would like to see the results of$HPQ-5.0%, $HRL-2.2% and $COST-5.2%.

What do you think of Block $SQ0.6%?

I recently came across this company and was quite taken with it. Block is a technology company that operates in the financial technology sector and provides a well-known mobile app Cash App. For me, overall, a very interesting company that has a good momentum.

I look at the flash news and see that Cathie Wood and Ark Invest have bought over 100,000 shares of PayPal. I used to think about $PYPL-5.4% stock , but it's not for me and I'd rather put my money elsewhere.

What do you think about...

Read more

Yesterday, $TGT1.5%stock was down 8% on the results and conservative earnings estimates for the rest of the year.

Anyone overbought?

Interestingly, even though this company is involved in a very similar or even the same sector as $WMT, each stock goes to a different side:) I guess the market is making it clear who is king.

What about the Tesla? Are you buying or selling?

Shares of $TSLA-10.4% are up more than 30% in the last month. I bought some time ago and have been holding ever since.

So far, neither. I've just been watching it for a while and haven't even bought any options there.

Lowe's $LOW0.3%reported results today . The results weren't terrible, but they certainly weren't positive, as indicated by the 2% drop in the stock. I don't have their stock in my portfolio, but if I had to pick from this sector, I' d choose$HD-0.5% stock instead .

Do you have $LOW0.3% or $HD-0.5%stock in your portfolio?

The results were in the final sum OK for me. We do have a worse outlook for this year, but the stock has fallen in line with that. If the company has lower EPS and sales, it can't go to a new high. Or actually it can, but we understand each other😁

What do you think of $HOOD-9.8%stock ?

Quite an interesting company for me. Its stock is up more than 60% this year, but that's too big a risk for me.

For me a great documentary on netflix in conjunction with this company. after watching it all I can say is hands off :D

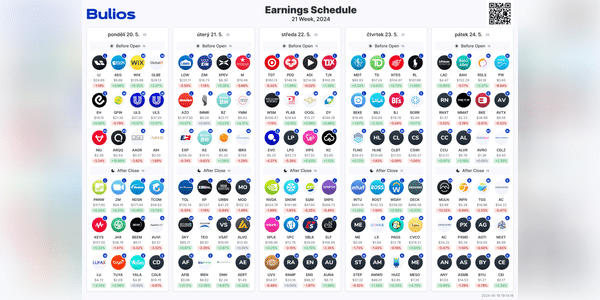

Which companies' results will interest you this week?

I am very curious about the results of $NVDA-7.4% and I will be interested in the results of $LOW0.3% and $TGT1.5%.

Investors, what stocks are you planning to buy/sell next week?

I'm still trying to accumulate cash, but I may overbuy $WBD-11.9%next week .

Shares of $WMT-4.7% soared 6% after earnings and Walmart surpasses a$500 billion market capitalization for the first time in history . I don't have this company in my portfolio as the sector is not that attractive to me.

Do you have $WMT-4.7%stock in your portfolio?

How do you feel about Virgin Galactic $SPCE-0.7%?

I am not very familiar with this company, but overall I find this sector terribly interesting and I wonder if any of you know anything more about this company.

More and more people have been mentioning this event lately. Yes, it's an asymmetric investment, so it's fine, but it's not for me. The costs are always going to be horrendously high, and I don't know if it's going to pay for itself.

I don't follow Alibaba, but the results don't look too bad. However ,$BABA-9.8%stock is down about 6%. I'm definitely not overbought, but I was happy to look at the results😁.

Are you overbought on this decline?

Do you have tobacco stocks included in your portfolio?

I have $BTI-4.9% and $MO-3.1%stocks in my portfolio . I keep the position the same size, but I haven't overbought in a while and don't plan to. These companies pay a very solid dividend. However, I am starting to worry about the future of this sector.

How do you approach $BABA-9.8%stock , do you see it as an investment or a speculation?

For me, a fine company and if I had to choose from China, it would be$BABA-9.8%. However, I don't have any Chinese stocks in my portfolio and I don't...

Read more

https://asia.nikkei.com/Economy/Foreign-direct-investment-in-China-falls-to-30-year-low China's response to this is to ban the disclosure of foreign investment flows into the country. Any money in this market is pure speculation.

What is your current perception of the $PFE-5.3%?

For me, a fine company that pays a nice dividend, but I don't have this company in my portfolio because of the dividend. For me, Pfizer is a bit of a speculation, so when the stock in my portfolio starts to turn at least a little green, I'll start selling.

PFE is a company that has not outperformed the index for me, when I look back 10 years it has virtually zero growth in all possible metrics except the pandemic. These exceptional profits have been distributed in bonuses, they have bought back some shares at bad prices and the rest has been wasted on acquisitions that are necessary to replace expiring patents and the outcome is very uncertain.

A shareholder who didn't sell at the top has zero profit in 10y, not counting dividends. These have increased over the last 5 years by about 5% and 3 years (covid!) 3%, so you can get an impression of how they think of (divi) shareholders.

I sold PFE in 2022 and very much regret buying it back last year, hold experience;)

Interesting company, but nowadays even big banks have these products in their selection and other companies have at least some alternative. Even so, the potential in this sector is high. The analysts' outlook is quite positive.