Hey, how are you guys even doing with the (DCA) overbooking these days? The indices and stocks keep going up and a few more of these up days/weeks and we have new ATH.

Are you overbought anyway or are you waiting for a correction?

Hey, how are you guys even doing with the (DCA) overbooking these days? The indices and stocks keep going up and a few more of these up days/weeks and we have new ATH.

Are you overbought anyway or are you waiting for a correction?

What do you think about the speculation about AMD $AMD and Amazon $AMZN? AMD has unveiled high-performance AI chips called MI300 and there is speculation that one of the biggest customers may be Amazon.

...China's central bank cut its short-term interest rate for the first time in 10 months on Tuesday to restore market confidence and support a slowing economic recovery in the world's second-largest economy after the pandemic.

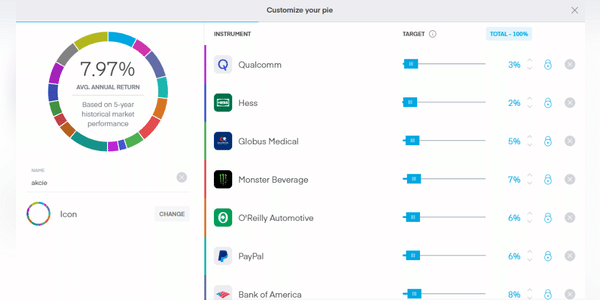

...Okay guys, I'm going to go to the market with my skin on and I want to hear your opinions. This is what my portfolio looks like after last week's edits. I'd love to hear what you have to say about selection, composition, riskiness, diversification, what you wouldn't buy for example, and conversely, what you would change or add for example?

Except for $PYPL, we disagree on nothing. To me there is a lack of greater diversification across sectors, but the potential is great because of it. I might still ask myself if you manage to actively follow all these companies and understand them all, but 16 titles might be fine. If I were you I would probably gradually sell off the more profitable titles that are at high levels (Apple, AMD,...), which I don't advise of course. I did that myself and my portfolio is now more defensive.

Fingers crossed!

So I finally added the Lucid $LCID to my portfolio last week and I'm glad I did. In addition, news came today that Lucid is preparing to enter the world's largest automotive market, China.

...

It doesn't look like much to me either... in china, they'll go up against $NIO, and that's not gonna be fun...

I have a question more suitable for discussion. I often see in the premarket that various stocks are rising, and in a given report on investment sites, for example, it's stated that it's rising based on a change in analyst ratings.

Does it really work like that? But then that can also smack of market manipulation can't it? I'll give you an example 👇

...Sometimes it really is. Movements outside of trading hours are mostly based on news...

S&P Global Ratings upgraded Nvidia's $NVDA rating to 'A+' from 'A' with the expectation that the chipmaker will be able to generate stronger growth over the next few years.

...He may very well keep going, but jumping in at the moment doesn't seem sensible to me anymore.

Analysts at Evercore ISI raised their target for the S&P 500 $^GSPC index to 4450 from the previous 4150. According to them, continued AI-driven momentum could push the index to 4450 by July 4.

...What about that Lucid $LCID today? I see it's down another 9% in the premarket. Speculatively I guess I'd take it, the Arabs obviously trust them since they still have the biggest share there. Their EVs are pretty interesting, but it's still too young a company for me, so I wouldn't open anything big there, just speculation on a bounce.

I wouldn't invest, I think it's a big risk. The Arabs have plenty of money, and hopefully they've got the math right, but I'm staying out of it anyway.

Guys, I need some inspiration. Which stocks have you bought lately, or are you on the lookout for. I seem to be losing track of interesting, or solidly minted companies as the markets go up to space again.

...Now that's a total top!

Nvidia $NVDA said it is building the most powerful AI supercomputer to meet growing customer demand for AI applications.

...Until today I lived with the fact that I only know teraflops, but I guess I haven't looked at the new capabilities of computers for a long time...😅

I don't know about you, but I'm going to take advantage of Xpeng $XPEV's drop to $8 today to expand my portfolio to include electric car makers. It may not make sense to everyone, for me $8 was a buy target. Sales, profits and even their deliveries may not be impressive to everyone, but guys, if you like cars, check out the XPeng P7 and the reviews right away. I'm telling you,...

Zobrazit více

Virgin Galactic $SPCE, the space tourism company, is ready today to launch its first space mission in nearly two years, the last planned test flight with a crew of six before launching its long-awaited commercial service!

I'm not investing here, but I'm definitely a big fan and have my fingers crossed that they succeed. I see a future in this, but investment-wise it doesn't make...

Zobrazit více

It's interesting and I can see the potential. I agree with the others, I'm also waiting for SpaceX.

Although I am no stranger to the smell of money, I avoid China, despite its, I don't know what to call it, great potential, shall we say? I'm not condemning anyone for investing in China, I consider it risky and another research report confirms me in this.

Yes, I did, I opened an article with a clear clickbait headline on Yahoo: China's economy is rotten and its booming...

Zobrazit více

I'm not investing in China yet. Maybe in the future I will buy something, but the bare minimum for diversification and to have something invested in this market.

That's what DCA is for. Whatever the price, keep buying