Cisco — Stock Performance, Technical View & Future Expectations

Let’s check out the recent performance & future expectations of Cisco. The stock is now moving in a downtrend channel as the economic crisis dictates. Cisco delivered rock-solid financial results which calmed the shareholders. The tech giant also has an attractive dividend yield rate, luring investors like moths to a flame. Although, most profitable product categories dropped year-over-year. The most important question arises, is Cisco worth a shot?

Recent Performance

Cisco reported fourth quarter and fiscal year on March 31, 2022. The company has delivered $13.1 billion revenue, which is flat year-over-year and decreased EPS ration booth GAAP and Non-GAAP. Here are some brief financial results:

Revenue: $13.1 billion — flat year-over-year

• Secure, Agile Networks: $6.1 billion — 1% down

• Internet for the Future: $1.3 billion — 10% down

• End-to-End Security: $984 million — 20% up

Net Margin: 22.91%

Operating Cash Flow: $3.7 billion

Cisco Systems operates in the industry of networking hardware and software. The segment of Secure & Agile networks has the greatest impact on the revenue. Additionally, the firm has a stable portfolio of specific tech markets. It is not meant stable by revenue, but stable by specialization. The biggest up by revenue was the product category of End-to-end security, as mentioned before.

The reported revenue was higher than expected, beating analysts' estimates of $12.7 billion. This is an excellent performance for the company. The other metric showing the company is doing great is that they are also guided for the future at 2-4% for the fall quarter on year-over-year revenue, which beats the expectations by analysts of 0.6% year-over-year.

Cisco has historically taken a big plunge after the year 2000. The company still has not recovered related to the price peak from more than 22 years ago. The price peak we had at the turn of this year was still more than 20% below.

$CIS.BR also consistently generates excellent cash flow. They can pay off their debt with only two years of their last five years of free cash flow, and that is a great factor. The company also has an impressive gross margin of 62.55%.

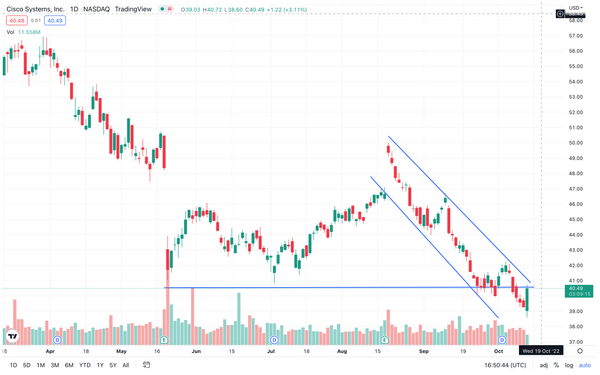

Stock Technical View

Despite the great performance stock had within financials, price per share is continuously dropping since the end of August. In May, a support was formed which bounced off the Bears for a couple of times. Afterwards, the support on the $40 line was inevitably broken due to the macroeconomic crisis. However, not losing huge amounts. Currently, Cisco stock is moving in the range of $38.5-$41 per share, which is 40% down since the peak at the end of the last year.

Price of the company having the ticker CSCO, publicly traded on Nasdaq, is now moving in a downtrend, and it is hard to say, if the stock price will get off the recent trend channel. There is a market insecurity which paralyses predictions to a certain extent.

The company offers a safe dividend with a yield of 3.5%. Nevertheless, the U.S. 10-year Treasury note provides a similar yield. Cisco Systems has also spent over $75 billion on stock buybacks, since the fiscal year 2013. The company has an outstanding share ration of -17%.

Cisco’s Future

Cisco Systems has managed 55 acquisitions since 2015. It is worth bearing in mind, Cisco is a world’s largest networking-hardware company. Nonetheless, the company seems confident in its ability to grow both in revenue and net income. Despite the economic crisis, by the financials, the firm looks rock-solid.

According to the Wall Street Journal, analysts’ ratings vote in the majority for holding the stock. The target price is estimated to the average price of $53.89 per share. Additionally, the company had the highest full year non-GAAP earnings per share in the history of the company, said Chuck Robbins, CEO of Cisco.

Cisco’s vision for the future is to achieve net-zero emissions by 2040, and the firm is committed to it. Cisco is driven by innovation and the segment has still a lot to offer. We'll wait to see if Cisco can stand against the headwinds of recent unpleasant situations.

Tradematics