So, as expected, we have a pause in the rate hikes!

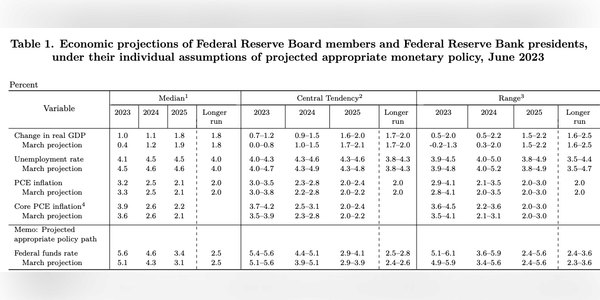

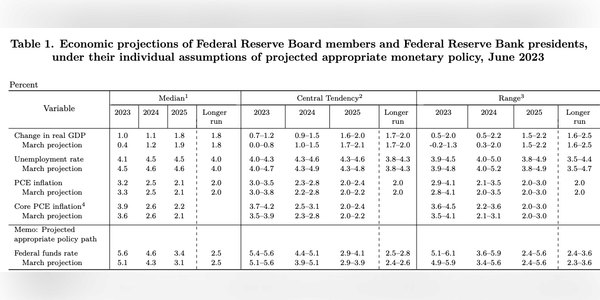

However, Jerome Powell and the Fed now expect the Fed Funds rate to be 50 basis points higher than the current level at the end of this year.

What do you think?

So, as expected, we have a pause in the rate hikes!

However, Jerome Powell and the Fed now expect the Fed Funds rate to be 50 basis points higher than the current level at the end of this year.

What do you think?

My favorite Broadcom $AVGO company is about to rock 🔥.

US chipmaker Broadcom is set to get conditional EU antitrust approval for its proposed $61 billion acquisition of VMware!

...It's definitely great news for investors. I don't invest in the company and I don't have much interest in it. However, as I watch and read, I think I made a mistake and will take a closer look at the company.

I'm taking a long look at pharmaceutical stocks right now, where I'm recently invested in $JNJ. But I'd like to add at least one more representative from that sector to my portfolio. Any tips? Alternatively, what do you find interesting in terms of price as well?

Meta Platforms on Thursday unveiled WhatsApp's so-called "channels," a feature the social media giant says will help turn the app into a "private broadcast messaging product."

...As @nikgab wrote, it probably won't bring them any extra big money, but the news is great and I'm glad they're doing other things.

Another reason why I'm not worried about TSMC's future despite the potential risk of conflict with China 👇

Taiwanese chipmaker TSMC said it is on track to open its first European factory in Germany and is discussing subsidies with the host country's government, the company's chairman said on Tuesday.

...So that's really good news if they actually open a branch in Europe eventually. I like the company too, but I left it because of the environment. Too bad, now I don't know the price, but then again maybe in 5 years it can be much higher. The initial purchase for 63$ is great! 👍

I somehow missed this, but Disney $DIS said Friday that it has removed certain produced content from its direct-to-consumer (DTC) services and will record a related $1.5 billion impairment charge in its fiscal third-quarter financial report.

...Volkswagen has decided to reintroduce its iconic VW Bus model to the North American market, this time in an all-electric version. This is to get Tesla to put the pedal to the metal with those buses 😄 VW is starting to grow famously in the EV space, both in passenger cars and now their popular buses.

Do you have shares of $VWAP.BR?

Again, the numbers are good, but the product loses quality. That's why I'm not investing in the company, maybe I'm making a mistake, but I'm sticking to my strategy.

HP missed earnings estimates and is down more than 4% in the premarket. I think the PC and printer segment will limp along for a while before demand stabilizes again. So if the share price continues to fall, I have a new candidate for the portfolio. I'll probably wait one more quarter to get more insight on demand, but as I write, I don't expect improvement anytime soon, which...

Zobrazit více

Great, thanks for the recap.

I have the same approach as you. If the share price continues to fall, I will also include this stock in my portfolio.

I think Netflix is definitely on its way to becoming a leader in its industry. But Oppenheimer's new price target of $450 per share strikes me as a good deal. The company is indeed launching a new paid account sharing plan, but that growth of nearly 100% in a single year seems nonsensical to me. Instead, I would expect a reduction in the price target given the market...

Zobrazit více

Absolutely nothing against Meta Platforms $META, but I don't really understand how Loop Capital analysts can now give a $320 target. Also, is anyone here too bullish and can give me reasons for this? 🤨

I also don't find$META attractive at the moment, although I used to own shares of the former $FB, I think the company will go lower and lower over time, I don't see anything that would pull me to invest for the long term. I especially think Meta stock needs some cooling off at the moment after the big run up. The target price doesn't seem entirely realistic to me either.

Does anyone here know the stock of $TEF (a telecommunications company from Spain). I've been looking at them for some time now for an interesting dividend and today we're down 4% in the pre-market as the company said its first quarter net income fell 58% from the same period last year to 298 million euros ($328 million) due to higher debt costs (Earnings were impacted by a 19%...

Zobrazit více

I always wonder when I look at a chart like this, why has their share price been falling for so many years ( 23 in this case) and what would have to happen for it to suddenly start rising?

They are doing well there and want to avoid the mistakes of the past. If it was like that everywhere, it would be good.